First Majestic's Q1 Production Reaches New Record of 3.63 million Silver Equivalent Ounces

April 8, 2014

Download

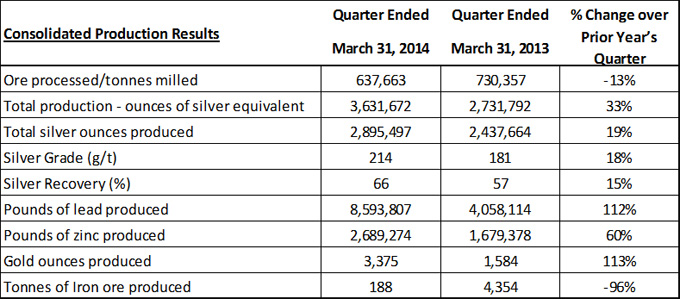

Total silver production for the quarter consisted of 2,895,497 ounces of silver, representing an increase of 19% compared to the same quarter in 2013. In addition, 8,593,807 pounds of lead and 2,689,274 pounds of zinc were produced, representing an increase of 112% and 60%, respectively, compared to the same quarter of the previous year. Also produced were 3,375 ounces of gold, representing an increase of 113% compared to the first quarter of 2013.

Keith Neumeyer, President & CEO of First Majestic, states, “Our first quarter results show a great start to the new year. Even though some challenges existed in the quarter, other improvements that were implemented in 2013 are taking hold. With many exciting initiatives underway in the areas of automation, processes and metallurgy, we are setting ourselves up for another record year of production”.

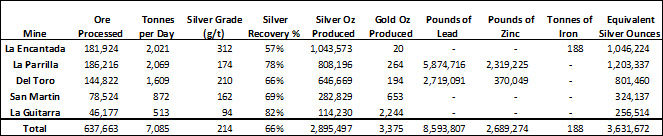

Production Details Table:

Operational Review:

The total ore processed during the quarter at the Company’s five operating silver mines: La Encantada, La Parrilla, Del Toro, San Martin and La Guitarra, amounted to 637,663 tonnes milled, representing a 9% decrease over the previous quarter primarily due to the elimination of old tailings in the ore blend at La Encantada.

Silver grades in the quarter for the five mines increased by 12% to 214 g/t compared to the previous quarter. Combined silver recoveries averaged 66% in the quarter, an improvement over the fourth quarter average of 64%. These improvements were primarily the result of the changes occurring at the La Encantada Silver Mine.

The Company’s underground development in the first quarter consisted of 12,215 metres, an 8% decrease compared to 13,280 metres completed in the previous quarter. This decrease is part of a planned reduction of capital expenditures aimed at reducing costs due to the lower metal price environment.

During the quarter, nine diamond drill rigs were operating at the Company’s five operations. The Company completed 7,190 metres of diamond drilling in the quarter, compared to 8,324 metres in the prior quarter, representing a 13% decrease.

The table below represents the operating parameters at each of the Company’s five producing silver mines. Starting in 2014, the Company has adopted the use of calendar days versus operating days for its average throughput calculations.

Mine by Mine Quarterly Production Table:

The following prices were used in the calculation of silver equivalent ounces: Silver: $20.48 per ounce; Gold: $1,297 per ounce; Lead: $0.95 per pound; Zinc $0.92 per pound and Iron $148 per tonne.

At the La Encantada Silver Mine:

- The cyanidation mill averaged 2,021 tpd during the quarter, all from underground mine ore. As previously announced, the reprocessing of old tailings has been removed from the current mine plan awaiting higher silver prices. As a result, the silver grade has increased by 37% to 312 g/t, a considerable improvement over the previous quarter.

- Underground mining continues from the San Francisco vein and the “990” and “990-2” chimneys. Additional production from level 1850 at the Buenos Aires extension and the recently discovered Regalo Vein and Breccia are now active. These new areas, along with the Milagros Breccia which is currently undergoing mine preparation, will support the planned increase in fresh mine ore production to reach 3,000 tpd by year end.

- Four drill rigs were active underground at La Encantada during the quarter. A total of 5,923 metres of exploration and definition drilling was completed in the first quarter, compared to 6,611 metres of drilling in the previous quarter. In addition, a total of 2,842 metres of underground development were completed in the first quarter, compared to 3,210 metres of development in the previous quarter.

- A substantial portion of the current drilling and development is for the purpose of the planned release of an updated NI 43-101 Technical Report.

- During the quarter, La Parrilla continued to operate above budget having processed 186,216 tonnes of ore (82,318 tonnes of oxides and 103,898 tonnes of sulphides) with an average silver grade of 174 g/t. Silver production totaled 808,196 ounces during the quarter and remained consistent with the previous quarter.

- A new lime feed automation system was installed at La Parrilla during the quarter. The new system is part of the Company’s mandate to invest in automation technologies to increase milling efficiencies. This new installation is designed to help optimize and stabilize cyanide consumption levels as well as increase visibility of the pH levels in each of the leaching tanks.

- In order to increase the recovery and grade of the zinc concentrates, a new zinc flotation cell was successfully installed in late February. As a result, total zinc production during the quarter increased by 45% to 2,319,225 pounds compared to the previous quarter.

- Average production at the Vacas mine has now reached 500 tpd, and preparation for long-hole mining is being prepared for initial start-up in the second quarter.

- Underground development completed in the quarter totaled 2,255 metres compared with 2,989 metres developed in the previous quarter.

- One underground drill rig was active within the La Parrilla property during the quarter. A total of 448 metres were drilled in the first quarter compared to 249 metres in the previous quarter.

- Effective January 1, 2014, the new cyanidation circuit was deemed commercial having reached commercial operating levels. However, due to a mechanical issue at one of the oxide thickener tanks, the treatment of oxide ore was suspended for a period of two weeks during the quarter. As a result, the flotation circuit was temporarily ramped up to offset the reduced throughput in the cyanidation circuit.

- Total mill throughput increased by 18% during the quarter to average 1,609 tpd (735 tpd in cyanidation and 874 in flotation) containing an average silver grade of 210 g/t. This resulted in an 18% increase in silver production to 646,669 ounces compared with the previous quarter. Average silver recoveries were 66% and remained in-line with the previous quarter. Metallurgical testing continues on-site aimed at improving recoveries to levels indicated in the Pre-Feasibility Study (PFS) dated August 20, 2012.

- Throughout most of the first quarter, electrical power was supplied to the mill by seven diesel generators. On March 11, the Company successfully connected to the Mexican national power grid with a 34kV power line which has allowed five of the seven generators to come offline at the end of March. With only two diesel generators remaining active, the Company now anticipates a substantial reduction in cash costs for the remainder of the year as a result of lower electrical costs per kilowatt.

- The construction of the larger 115kV power line is now more than 90% complete and is expected to be completed by the end of the second quarter following a route change. Once complete, the Del Toro operation will be fully connected to the Mexican power grid allowing for further power cost reductions.

- During the quarter, one underground drill rig was active at Del Toro. Total exploration metres drilled in the first quarter amounted to 297 metres, compared to 799 metres drilled in the previous quarter. In addition, 2,322 metres of development were completed in the first quarter, compared to 2,612 metres of development in the previous quarter.

- During the quarter, San Martin processed 78,524 tonnes of ore with an average silver grade of 162 g/t. Silver production totaled 282,829 ounces during the quarter and remained consistent with the previous quarter.

- Due to a mechanical breakdown in the main gear of the 10’ X 10’ ball mill, production was suspended for a period of nine days while maintenance work occurred. The ball mill was successfully fixed and milling has since resumed to normal operating levels.

- The ramp up to 1,300 tpd has been slower than expected due to some unexpected issues with piping capacity, ball mill mechanical interruptions and clarifying filter capacity. The projected ramp up to mill capacity is now expected to be achieved in the second quarter.

- Underground development completed in the first quarter totaled 3,219 metres, compared with 2,858 metres of development in the previous quarter. The mine development continues to be focused at the Rosarios mine where six areas are now in production.

- One underground drill rig was active within the San Martin property during the quarter. Total metres drilled in the first quarter amounted to 276 metres, compared to 387 metres of drilling in the previous quarter.

- During the quarter, La Guitarra averaged 513 tpd with an average silver grade of 94 g/t and an average gold grade of 1.8 g/t. Total production during the quarter consisted of 114,230 silver ounces and 2,244 gold ounces. This represents a 20% decrease in silver production over the previous quarter primarily due to a 20% decrease in the silver grade.

- During the quarter, production ore continued to come from areas within the La Guitarra vein which contained higher gold grades in conjunction with lower silver grades. Dilution, grade control and laboratory procedures are being reviewed in order to increase the silver grade at the mine.

- Mine development at the Joya Larga structure within the El Coloso area has now reached 300 metres along the vein. Drifting continues along the Joya Larga structure in an effort to reach the higher silver grade areas.

- A total of 1,577 metres of development were completed in the first quarter, compared to 1,611 metres of development in the previous quarter.

- Two underground drill rigs were active in the first quarter within the La Guitarra property. Total metres drilled in the quarter amounted to 246 metres compared to 278 metres drilled in the previous quarter.

FOR FURTHER INFORMATION contact info@firstmajestic.com, visit our website at www.firstmajestic.com or call our toll free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

“signed”

Keith Neumeyer

President & CEO

Cautionary Note Regarding Forward Looking Statements

This press release contains “forward-looking statements”, within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of First Majestic Silver Corp. Forward-looking statements include, but are not limited to, statements with respect to the future price of silver and other metals, the estimation of mineral reserves and resources, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, hedging practices, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, timing and possible outcome of pending litigation, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of First Majestic Silver Corp. to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the integration of acquisitions; risks related to international operations; risks related to joint venture operations; actual results of current exploration activities; actual results of current reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of metals; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section entitled “Description of the Business - Risk Factors” in First Majestic Silver Corp.’s Annual Information Form for the year ended December 31, 2013, available on www.sedar.com, and Form 40-F on file with the United States Securities and Exchange Commission in Washington, D.C. Although First Majestic Silver Corp. has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. First Majestic Silver Corp. does not undertake to update any forward-looking statements that are incorporated by reference herein, except in accordance with applicable securities laws.