Overview

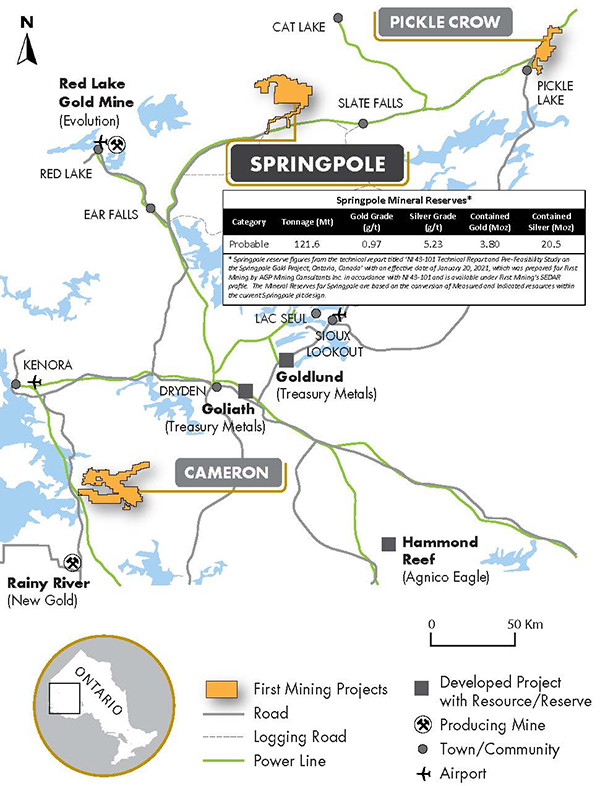

On June 11, 2020, First Majestic announced that it has agreed to acquire from First Mining, a stream on 50% of payable silver produced from the Springpole Gold Project located in Ontario, Canada. First Majestic will make ongoing cash payments of 33% of the silver spot price per ounce, to a maximum of $7.50 per ounce, for all payable silver delivered by Springpole. First Majestic has agreed to pay First Mining total consideration of $22.5 million in cash and shares, over three milestone payments, for the silver stream which covers the life of the Project. During the mines life it is anticipated that it will produce approximately 22 million ounces. The transaction adds significant upside potential to higher silver prices, as well as substantial exploration upside over the large land holdings of over 70,000 hectares.

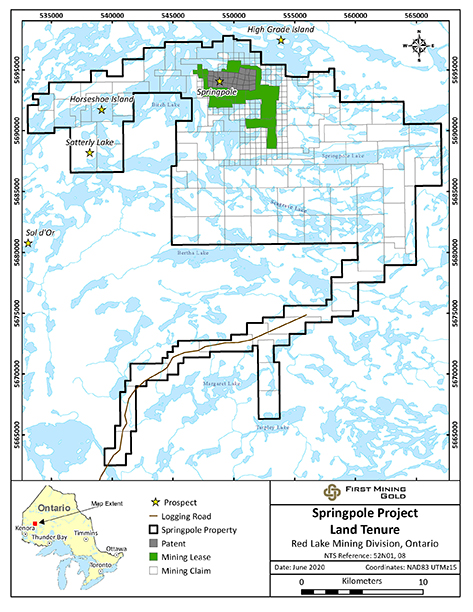

Location

110 km northwest of the town of Red Lake, Ontario, Canada

Area

70,000 hectares

Metals

Stream on 50% of Payable Silver

Project Highlights

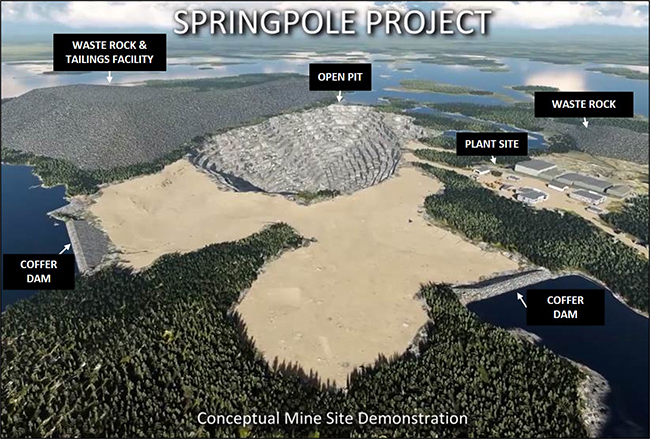

- At the Pre-Feasibility Study (“PFS”)-Stage the Springpole Gold Project is One of the Largest Undeveloped Open Pit Gold Deposits in North America

- Probable Reserves: 121.6 Mt at 0.97 g/t Au, 5.23 g/t Ag. Containing 3.8M ounces of gold and 20.5M ounces of silver

- Indicated Resource: 151 Mt at 0.94 g/t Au, 5.0 g/t Ag. Containing 4.6M ounces of gold and 24.3M ounces of silver

- Inferred Resource: 16 Mt at 0.54 g/t Au, 2.8 g/t Ag. Containing 0.3M ounces of gold and 0.3M ounces of silver

- Significant infrastructure in-place or proximal to project: 72-man camp onsite, winter road access, logging road within 10 km, and power lines nearby

- Project is located in a pro-mining jurisdiction within Treaty Nine and Treaty Three First Nations Agreement lands

- Positive Pre-Feasibility Study (“PFS”) completed in 2020, see news release dated January 20, 2021

- Strategic funding in place to support project through Environmental Assessment process

2020 PFS Highlights

The Springpole Gold Project, located in northwestern Ontario, Canada, is one of the largest undeveloped open pit gold projects in North America. The Project is located approximately 110 kilometres northeast of Red Lake. Springpole currently hosts 4.6 million ounces (“Moz”) of gold in the Indicated Mineral Resource category and 0.3 Moz of gold in the Inferred Mineral Resource category, as set out in the table below.

The PFS evaluates recovery of gold and silver from a 30,000 tonne-per-day (“tpd”) open pit operation, with a process plant that will include crushing, grinding, and flotation, with fine grinding of the flotation concentrate and agitated leaching of both the flotation concentrate and the flotation tails followed by a carbon-in-pulp recovery process to produce doré bars.

PFS Highlights

- US$1.5 billion pre-tax net present value at a 5% discount rate (“NPV5%”) at US$1,600/oz gold (“Au”), increasing to US$1.9 billion at US$1,800/oz Au

- US$995 million after-tax NPV5% at US$1,600/oz Au, increasing to US$1.3 billion at US$1,800/oz Au

- 36.4% pre-tax internal rate of return (“IRR”); 29.4% after-tax IRR at US$1,600/oz Au

- Life of mine (“LOM”) of 11.3 years, with primary mining and processing during the first 9 years and processing lower-grade stockpiles for the balance of the mine life

- After-tax payback of 2.4 years

- Declaration of Mineral Reserves: Proven and Probable Reserves of 3.8 Moz Au, 20.5 Moz silver (“Ag”) (121.6 Mt at 0.97 g/t Au, 5.23 g/t Ag)

- Initial capital costs estimated at US$718 million, sustaining capital costs estimated at US$55 million, plus US$29 million in closure costs

- Average annual payable gold production of 335 koz (Years 1 to 9); 287 koz (LOM)

- Total cash costs of US$558/oz (Years 1 to 9); and US$618/oz (LOM)(1)

- All-in sustaining costs (“AISC”) of US$577/oz (Years 1 to 9), and AISC US$645 (LOM)(2)

Note: Base case parameters assume a gold price of US$1,600/oz and a silver price of US$20, and an exchange rate (C$ to US$) of 0.75. All currencies are reported in U.S. dollars unless otherwise specified. NPV calculated as of the commencement of construction and excludes all pre-construction costs.

(1) Total cash costs consist of mining costs, processing costs, mine-level general and administrative (“G&A”) costs, treatment and refining charges and royalties.

(2) AISC consists of total cash costs plus sustaining and closure costs.

Mineral Resource Estimate

Springpole Proven and Probable Reserves

| Category | Tonnes (Mt) | Grade Au (g/t) |

Grade Ag (g/t) |

Contained Metal Au (Moz) |

Contained Metal Ag (Moz) |

| Proven | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Probable | 121.6 | 0.97 | 5.23 | 3.8 | 20.5 |

| Total | 121.6 | 0.97 | 5.23 | 3.8 | 20.5 |

Notes:

- The Mineral Reserve estimate has an effective date of December 30, 2020 and is based on the Mineral Resource estimate that has an effective date of July 30, 2020.

- The Mineral Reserve estimate was completed under the supervision of Gordon Zurowski, P.Eng., of AGP, a Qualified Person as defined under NI 43-101.

- Mineral Reserves are stated within the final design pit based on a US$878/oz Au pit shell with a US$1,350/oz Au price for revenue.

- The equivalent cut-off grade was 0.34 g/t Au for all pit phases.

- The mining cost averaged CAD$1.94/t mined, processing cost averaged CAD$14.50/t milled, and the G&A cost averaged CAD$1.06/t milled. The process recovery for gold averaged 88% and the silver recovery was 93%.

- The exchange rate assumption applied was C$1.30 equal to US$1.00.

Mineral Resources inclusive of Mineral Reserves

| Category | Tonnes (Mt) | Grade Au (g/t) |

Grade Ag (g/t) |

Contained Metal Au (Moz) |

Contained Metal Ag (Moz) |

| Indicated | 151 | 0.94 | 5.0 | 4.6 | 24.3 |

| Inferred | 16 | 0.54 | 2.8 | 0.3 | 1.4 |

Notes:

- The Qualified Person for the Mineral Resource estimate is Dr Gilles Arseneau, Ph.D., P.Geo., an SRK employee. The Mineral Resource estimate has an effective date of July 30, 2020.

- Mineral Resources are reported in accordance with the May 2014 edition of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves.

- Mineral Resources are reported inclusive of the Mineral Resources that have been converted to Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- All figures are rounded to reflect the relative accuracy of the estimate. All composites have been capped where appropriate.

- Mineral Resources potentially amenable to open pit mining are reported within an optimized constraining shell using the following parameters:

- Metal prices of US$1,550/oz gold, US$20/oz silver, exchange rate of US$0.77:C$1

- Mining cost of CAD$1.62/t, processing cost of CAD$15.38/t milled, G&A cost of CAD$1.00/t milled

- Pit slopes varying between 35–50º depending on domain

- Gold recovery of 88% and silver recovery of 93%

- Mineral Resources are reported at a cut-off grade of 0.3 g/t Au.