Overview

The 100% owned La Joya Silver-Copper-Gold property was acquired in 2015 by First Majestic when it purchased SilverCrest Mines.

On August 10th, 2020 the property was optioned to Silver Dollar Resources Inc. Under the terms of the option agreement the Company has been granted an option to acquire an initial 80% interest and, if exercised, a second option to acquire and additional 20% interest. Silver Dollar will pay First Majestic a total of $1.3 million over the course of four years and must incur exploration expenditures on the property of not less than $1 million within three years of entering into a surface rights agreement. First Majestic will also receive 19.9% of the issued and outstanding shares in Silver Dollar within 45 days of the effective agreement and will also retain a 2% net smelter royalty interest if the option is exercised.

Within 30 days of exercising the first option. Silver Dollar has the right to exercise its second option and acquire the remaining 20% interest by issuing First Majestic a further 5% of the issued and outstanding shares. If Silver Dollar elects to not acquire the additional 20% from First Majestic the Companies will form a joint venture in relation to the property.

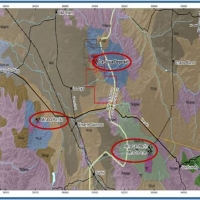

Location:

75 kilometres southeast of the city of Durango, Mexico.

- Excellent Infrastructure & Access: Highway

- Railway and Power Lines nearby

- 2 Hour Drive From Durango City & International Airport

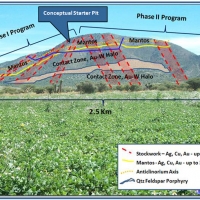

Geological Model & Completed Phase I & II Drill Program

On December 23, 2013, a technical report was released and titled, Preliminary Economic Assessment for the La Joya Property, Durango, Mexico, with an effective date October 21, 2013, as amended March 4, 2014 (“PEA”). The PEA was prepared following the standards established in NI 43-101 by EBA Engineering Consultants, a Tetra Tech Company (EBA).

The Company cautions that the PEA is preliminary in nature in that it is based on Inferred Mineral Resources which are considered too speculative geologically to have the economic considerations applied to them that would enable them to be characterized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The PEA focuses on the first stage of La Joya development ("Starter Pit") as a low strip, open pit with an initial 9-year life of mine plan ("LOMP"). The conceptual open pit operation would be in conjunction with a 5,000 tonnes per day (tpd) conventional mill and flotation/leaching plant to produce a high-grade silver-copper concentrate with gold credits.

La Joya Resources

In 2013, Silvercrest Mines Inc disclosed an Inferred mineral resource of 92.9 million silver equivalent ounces contained in 27.9 million tons of mineralized material which could be extracted by open pit mining methods. The resource estimate is reported to conform to CIM definitions for resource estimation. A qualified person of the Company has not done sufficient work to classify this historical estimate as current mineral resource and the Company is not treating this historical resource estimate as a current mineral resource. Independent data verification and an assessment of the mineral resource estimation methods is required to verify this historical mineral resource. The Company currently has no plans to explore or develop the La Joya project and as such, the project is in care and maintenance.

| Ag Eq Cut Off g/t |

Tonnage (M) |

Ag (g/t) |

Cu (%) |

Au (g/t) |

Ag (M Oz) | Au (K Oz) | Cu (M Lbs) | Ag-Eq* (M Oz) |

| Inferred 60 | 27.9 | 58 | 0.47 | 0.28 | 51.6 | 259 | 288.4 | 92.9 |

From NI-43-101 Technical report titled “Preliminary Economic Assessment for The La Joya Property, Durango, Mexico”, dated 5 December 2013

Key assumptions, parameters, and methods

- 89 holes totaling 30,085 m.

- Raw assay data was composited to 2 metre, capped at 550 gpt Ag, 5.5 gpt Au 6% Cu and interpolated into a block model using 5 m x 5 m x 5 m block size using inverse distance squared (ID2) methodology.

- Silver equivalency formula assumes Ag:Au is 50:1, Ag:Cu is 86:1, based on US$24/oz silver, US$1200/oz gold, US$3/lb copper and 100% metallurgical recovery.

- Mining by open pit methods.

- Mining and process costs assumptions not specifically stated.

Geology & Mineralization

The La Joya Property is underlain by Cretaceous sediments along the western margin of the Mexican Mesa Central, at the transition from the Sierra Madre Occidental, along the broadly defined San Luis-Tepehuanes fault system. The fault system is commonly referred to as the Mexican Silver Belt based on the country scale distribution of silver producing mines juxtaposed along the trend. The sedimentary package at La Joya consists of the Cuesta del Cura Limestone comprised of limestone with minor chert and siltstone overlain by the younger Indidura Formation comprised of calcareous siltstone, mudstone and siliciclastics.

The La Joya Deposit is a carbonate hosted copper skarn deposit with associated silver and gold mineralization, similar in style to the Fortitude-Copper Canyon deposit in Nevada, USA, and to the Sabinas/San Martin mines in Zacatecas, Mexico. Calcsilicate skarn mineralization is found on the property as andradite garnet, pyroxene, actinolite and wollastonite and is distributed amongst three styles of mineralization recognized to exist on the property. Ag-Cu-Au mineralization is concentrated within stratiform manto-style skarn controlled along sub-horizontal bedding. Ag-Cu-Au, Pb-Zn, and W mineralization is concentrated within structurally controlled stockwork and veining related skarn. Finally, W mineralization is found within late stage retrograde skarn development along the intrusive contact.

Sulphide mineralization generally transitions from chalcopyrite-dominant in proximal skarn to bornitedominant in distal skarn. Late sub-vertical laminated quartz-calcite veins bearing freibergite and arsenopyrite cross-cut pre-existing skarn mineralization and, although related to magmatic fluids, is not considered to be related to the skarn mineralizing events. Trace amounts of oxide from meteoric weathering processes are present within the structural corridors at depth.